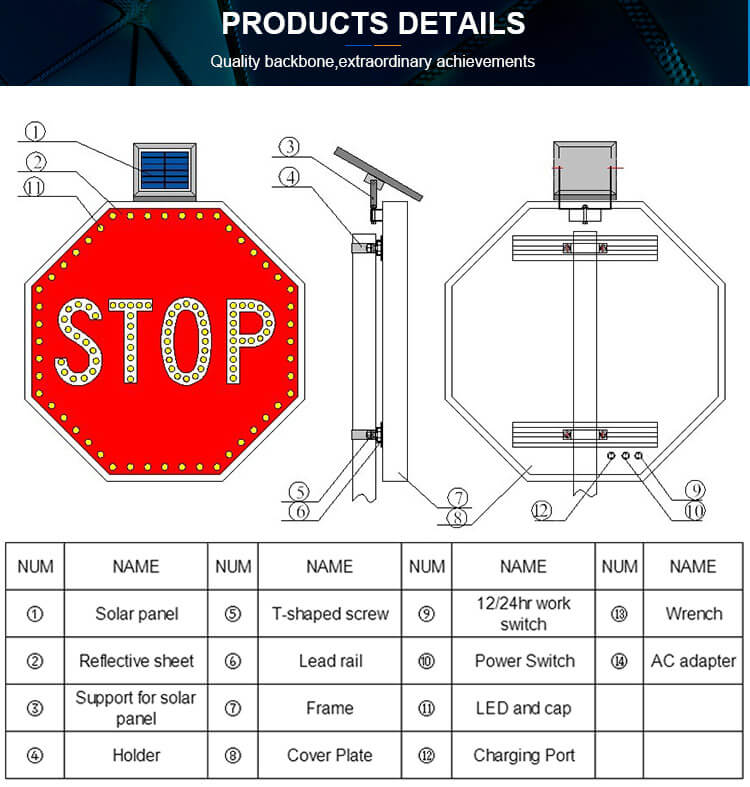

| Material: | Aluminium&Galvanized sheet |

| Reflective film: | 3M Engineering grade or 3M diamond grade |

| Solar panel: | 15V/8W or custom |

| Battery: | 12V/8Ah or custom |

| Voltage: | DC 12V or DC 11.1V |

| Leds distance: | <4.5CM |

| Led color: | Red, Yellow or White |

| Flashing frequency: | 50±2/min |

| Visual distance: | >800m |

| Working in rainy days: | 360H |

| Size: | 600mm /800mm /1000mm or Custom |

PG&E offers the Energy Savings Assistance Common Area Measures program to deed-restricted, multifamily buildings. To qualify, the property must be deed restricted and the owner must certify that at least 65 percent of the tenant households meet the ESA income guidelines. Learn more about the program. Opens in new Window.

The Annual Electricity Concession gives you a 17.5 per cent discount off your household electricity usage and service costs. Winter Gas Concession The Winter Gas Concession provides a 17.5 per cent discount off your gas usage and service costs from 1 May to 31 October each year.

The solar energy tax credit refunds 30% of the cost of installing solar panels for 2018 and 2019. In 2020 it will be 26%, and in 2021 the tax credit will be worth 21%. Therefore, it pays to get the work done now.

The answer depends heavily on your. specific circumstances. The IRS states in Questions 25 and 26 in its Q&A on Tax Credits13that off-site solar panels or solar panels that are not directly on the taxpayer’s home could still qualify for the residential federal solar tax credit under some circumstances.

The American Recovery and Reinvestment Act (ARRA) eliminates the dollar limit on the 30 percent tax credit for alternative energy equipment, such as solar water heaters, geothermal heat pumps and small wind turbines, installed in a home.

The credit for them is limited to $500 for each 0.5 kilowatt of capacity. Removal of the dollar caps for other systems means that if you purchase a $50,000 solar electric system, for example, your federal tax credit is a whopping $15,000. Previously, the credit was limited to $2,000.

We pay you up to 4X more for the solar energy that you don't use at home 3, so you can live greener and save more. Our clever technology connects to your battery, enabling us to make the most out of the energy you don't use, all whilst giving you access to powerful insights and full realtime solar and battery system monitoring.

The California Alternate Rates for Energy (CARE program) provides a 20% discount on monthly electric bills for qualifying households. To be eligible for CARE, customers must be full-time residents and their total household income must meet the income guidelines listed below: For each additional person in your household add $8,960.

18/8/2020 · You pay the reduced rate of 5% for work funded through energy efficiency grants on the: installation of heating appliances installation, repair and maintenance of central heating systems

With the Investment Tax Credit (ITC), you can reduce the cost of your PV solar energy system by 26 percent. Keep in mind that the ITC applies only to those who buy their PV system outright (either with a cash purchase or solar loan), and that you must have enough income for the tax credit be meaningful.

solar photovoltaic (PV) panels. wind turbines. hydro systems. solar water heaters, and. air source heat pumps. Owners have 2 options for receiving benefit for their STCs: Assigning them to an agent, usually the system installer, in exchange for a discount or delayed

Qualified energy-saving equipment includes: Solar-powered units that generate electricity or heat water Geothermal heat pumps Small wind turbines Fuel cell property (limit $500 for each half kilowatt of capacity) Solar-electric collecting roofs and roof products

Rebates and discounts. Our programs improve energy efficiency in the home. By accessing rebates and discounts you can cut back on your energy use, save on power bills and help the environment. These programs are available to eligible NSW residents. Energy rebates. Appliance replacement offer.

You may be able to take these credits if you made energy saving improvements to your principal residence during the taxable year. In 2018, 2019 and 2020, the residential energy property credit is limited to an overall lifetime credit limit of $500 ($200 lifetime limit for windows).

30/12/2020 · The credit is applied to the following tax year, so if you spend $10,000 on a new solar system, you’ll be able to take a credit of $3,000 the next year. This tax credit is available until 2022. The solar tax credit is a tax reduction on a dollar-for-dollar basis.